How to use company credit checks to protect your business

You need to know whether your customers are financially stable and pay on time…

Read more

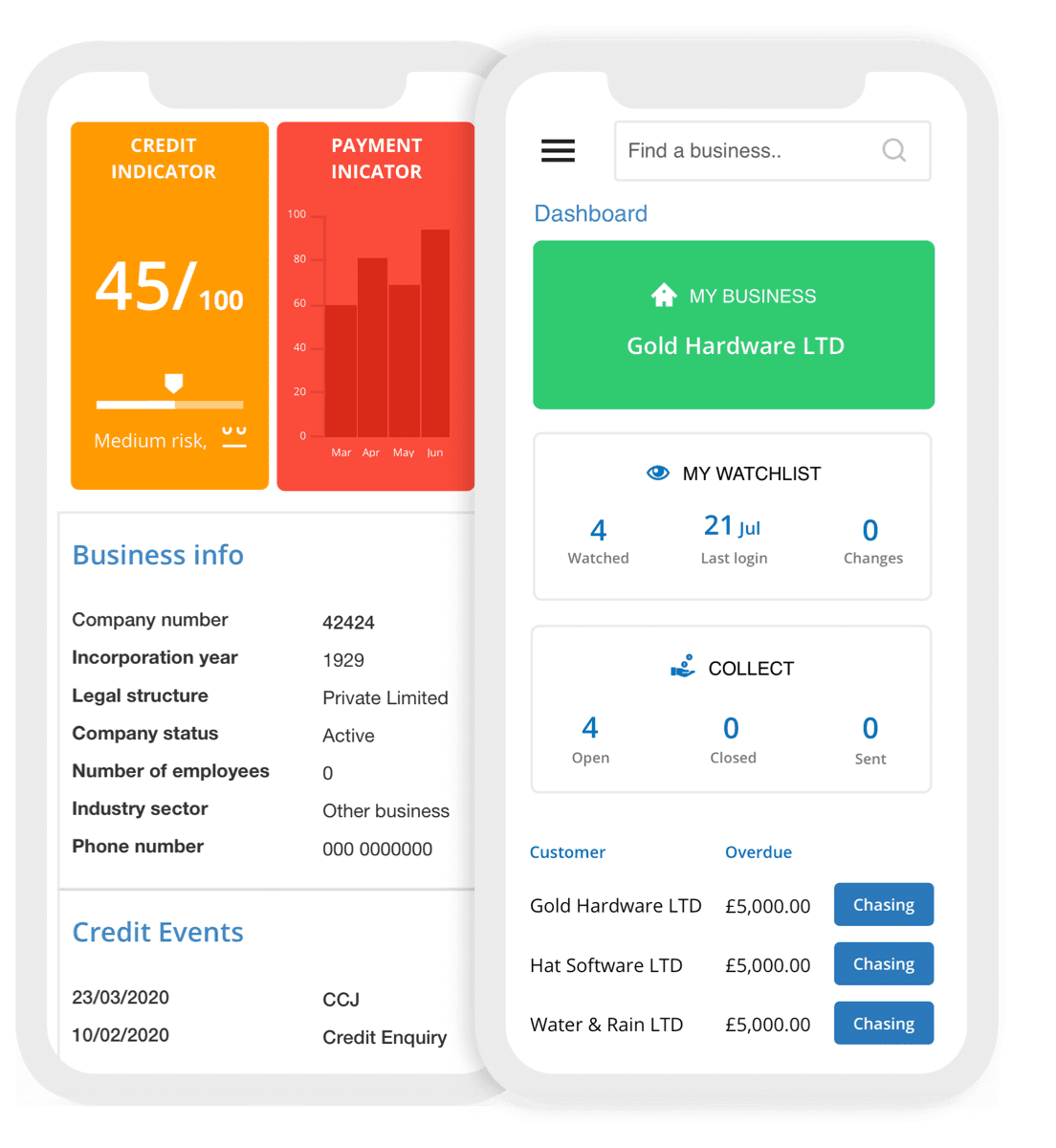

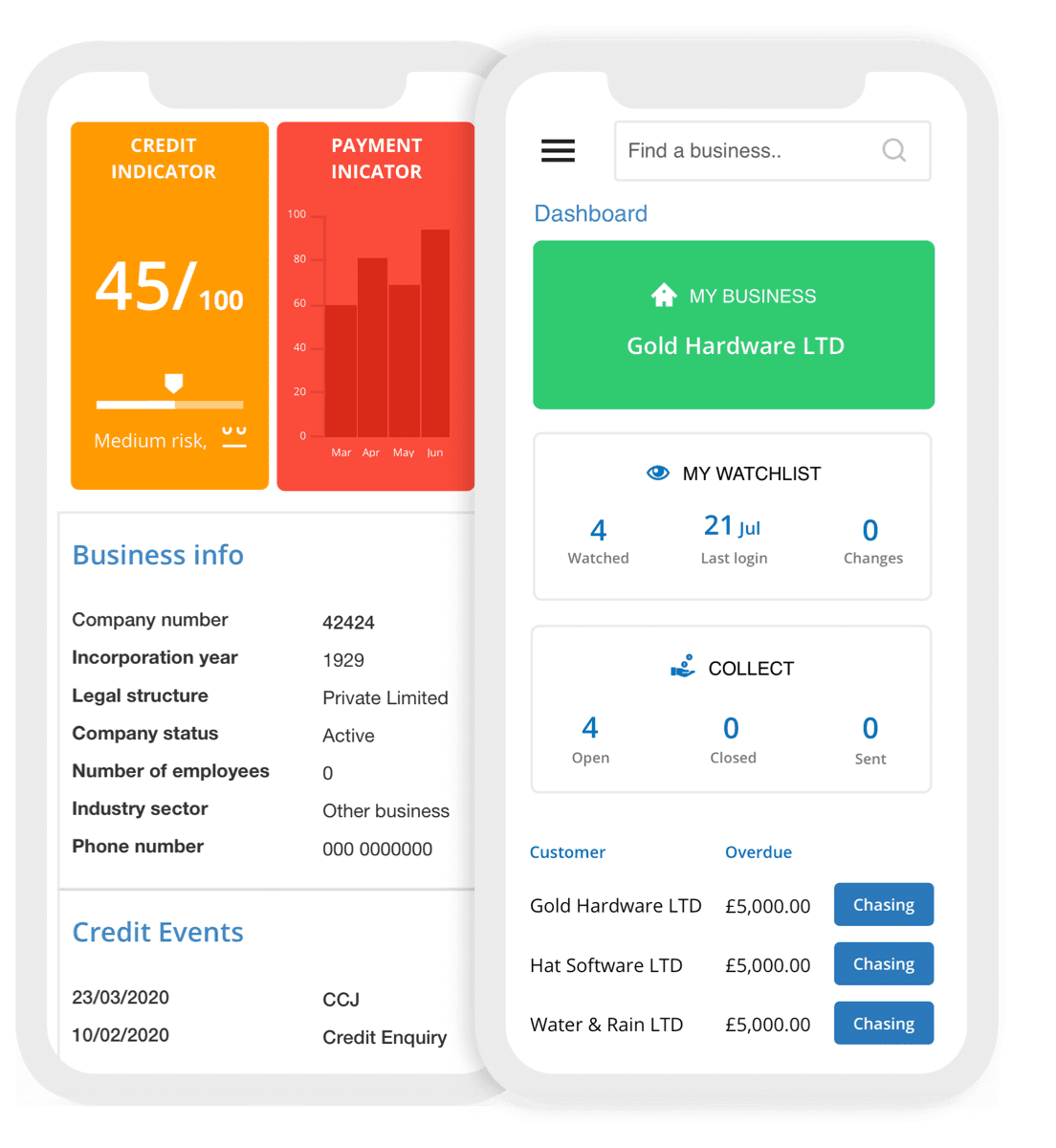

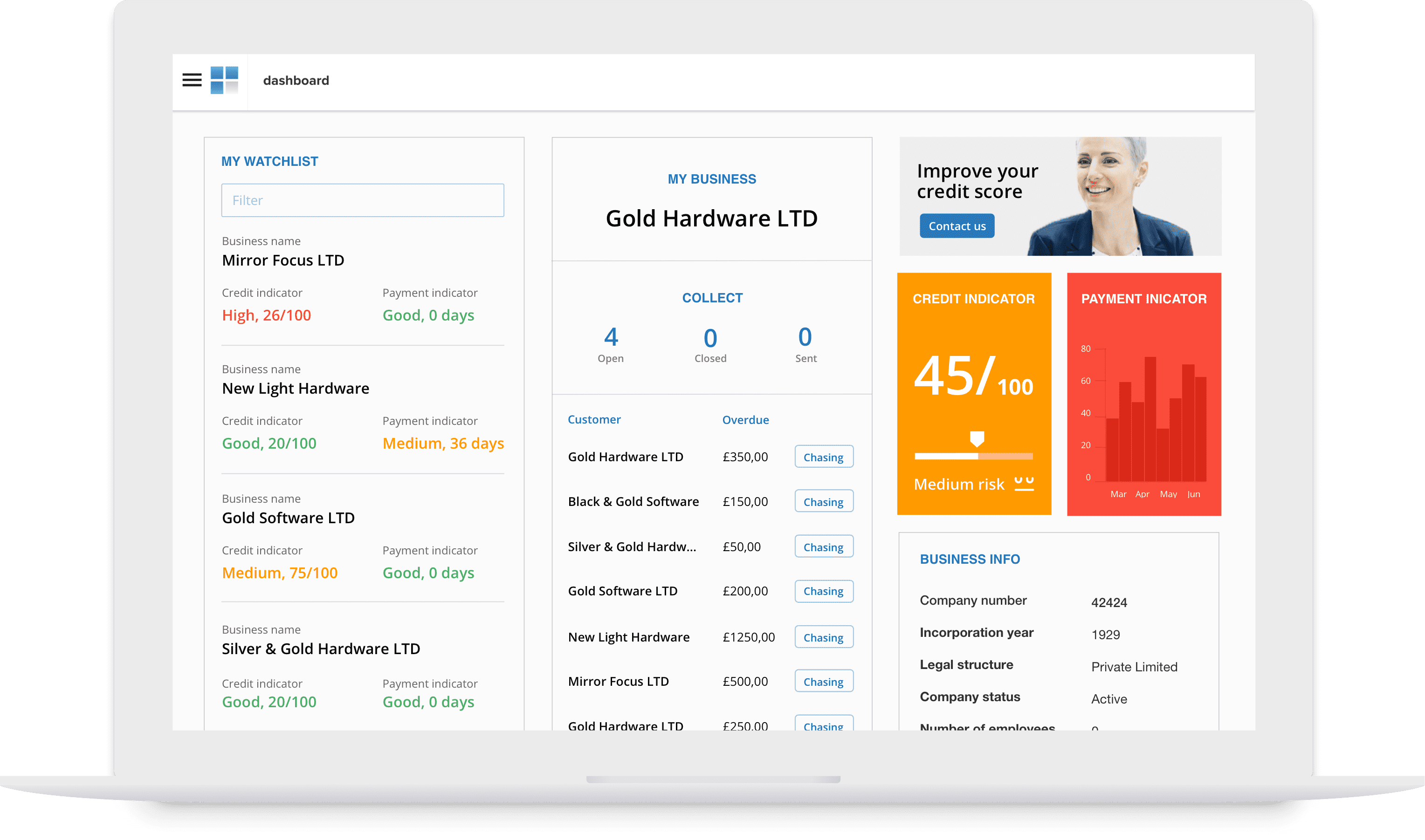

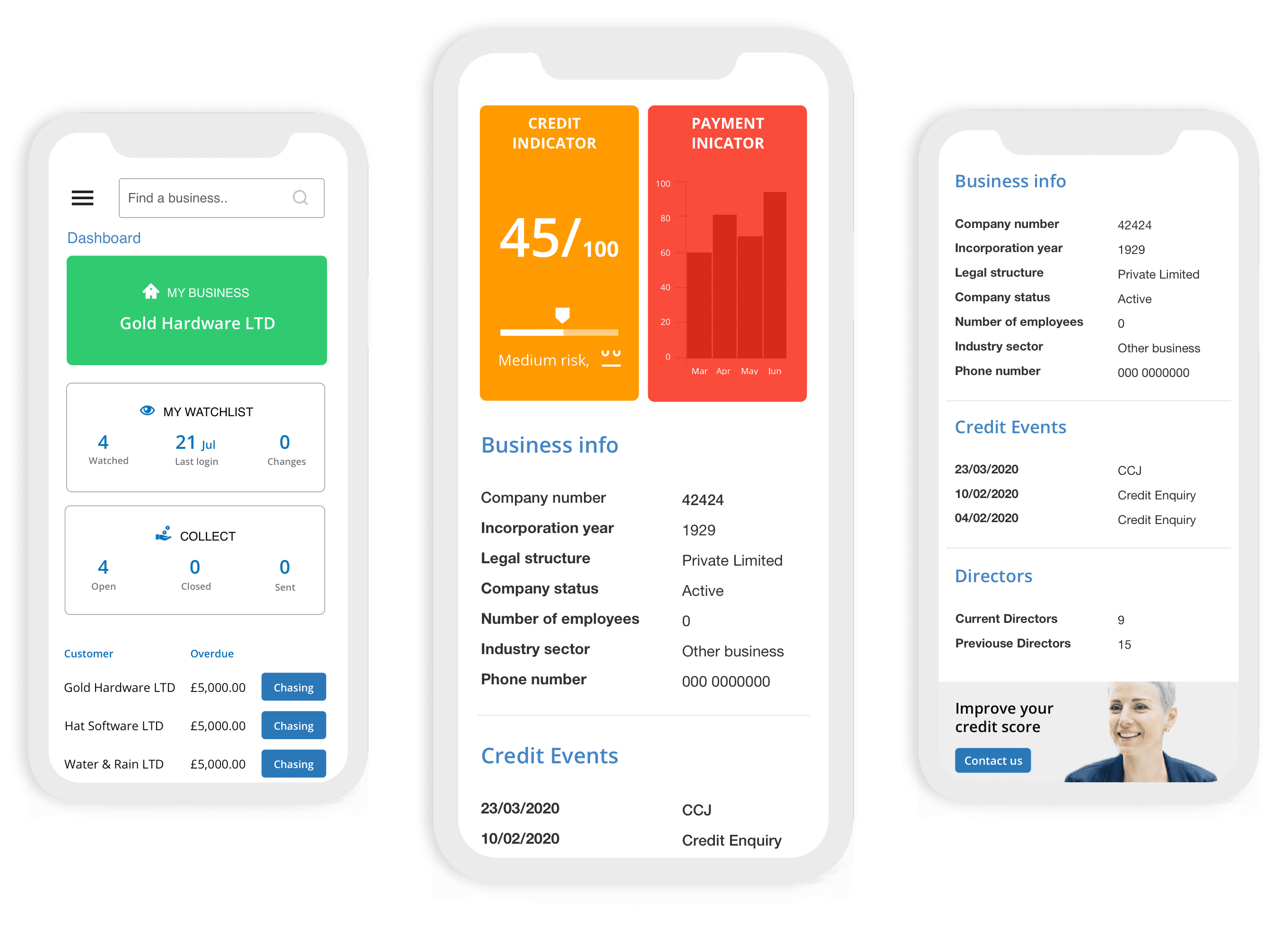

Identify how to improve your all-important business credit score and make sure all your customers and suppliers pay and deliver goods on time and in full with CreditFocus’ powerful, east to digest company credit reports and credit monitoring.

Take advantage of bespoke credit management advice for every business you credit check as well as the Credit Control Toolkit to effectively recover what you’re owed!

From £14.99/mo

It pays for itself the first time you credit check a company

DANIEL B.

Easy to use and very useful for small businesses

JACQUELINE F.

Times of economic uncertainty are a certainty. CreditFocus gives you the tools and knowledge to protect your cashflow before, during and after business relationships to help secure your company's future.

Access the Credit Control Toolkit to effortlessly manage credit and get paid on time and in full. Start legal proceedings to recover unpaid invoices with our expert commercial debt recovery partner!

Unfortunately, a firm handshake doesn't give you the information you need about a customer or supplier. You will with powerful CreditFocus company credit reports!

Using the most current and comprehensive data from Experian. The information you'll see will be current and correct.

Stay current with key customers, competitors, and suppliers to make sure you are the first to know of anything that can affect your business with credit monitoring.

You'll get short and long term credit advice for every business you check, helping mitigate risk of late and non-payment from the get-go.

Easily identify what has a positive and negative influence on your business credit score and improve it to make sure you get the best credit terms from lenders.

CreditFocus features protect your business's cashflow by mitigating the risk of late and nonpayment of invoices.

Comprehensive, easy to digest credit reports that show everything from company fillings to how many days late a business makes payments. With advice on how to manage credit with that business.

Add businesses to your watchlist and get alerted of any significant changes to their credit status that could affect the business relationship you have with them.

Send payment reminders, payment chasers, credit terms letters, monthly statements and solicitors final warning letters to make sure you're paid on time.

Get your business off to the best start possible

Improve your business credit score

Improve your business credit score Credit control toolkit and feature

Credit control toolkit and feature Commercial debt recovery

Commercial debt recovery£14.99/mo

Help your business grow by making, intelligent and informed decisions

Improve your business credit score

Improve your business credit score Credit control toolkit and feature

Credit control toolkit and feature Commercial debt recovery

Commercial debt recovery£29.99/mo

Everything you’ll need to effectively protect your business’s cashflow

Improve your business credit score

Improve your business credit score Credit control toolkit and feature

Credit control toolkit and feature Commercial debt recovery

Commercial debt recovery£49.99/mo

You need to know whether your customers are financially stable and pay on time…

Read moreIt’s crucial to stay up to date with your customers and suppliers credit status.

Read moreYou get recommended actions and easy-to-read, digestible business credit reports for businesses in the UK.

Read moreYou need to know whether your customers are financially stable and pay on time.

Read moreWhen you’re on track to sign a contract with a new customer, it’s easy to only focus on what challenges you might face keeping your end of the deal.

Read more